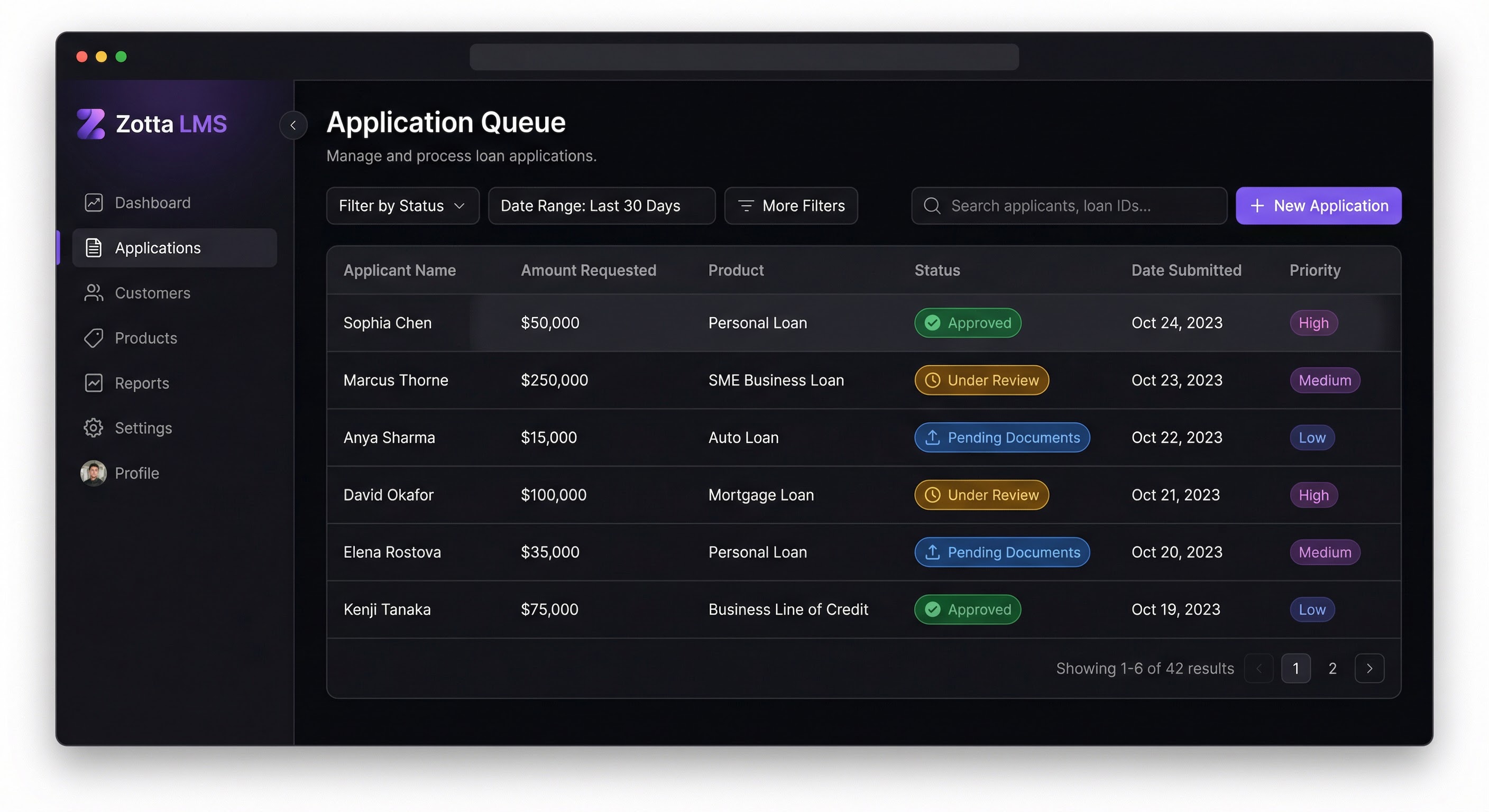

Streamlined Application Processing

Manage the entire application journey from submission to approval. A powerful queue system keeps your team organized, while automated document handling speeds up review times.

- Multi-channel application intake — web portal, walk-in, or agent-assisted

- Smart document upload with automatic ID parsing and validation

- Digital contract generation and electronic signature capture

- Real-time application status tracking for borrowers and staff

- Configurable priority queues with filters, search, and sorting

- Staff-created applications for walk-in customers

Champion-Challenger Scorecard Framework

Run multiple scorecards simultaneously, compare their performance in real time, and promote the best-performing model with a single click. Full control over your scoring strategy.

- Create, edit, clone, and import scorecards from CSV

- Side-by-side champion vs. challenger performance monitoring

- Gini coefficient, KS statistic, AUC-ROC, and PSI metrics at a glance

- Score distribution charts with configurable risk band thresholds

- What-if analysis — simulate impact of changing applicant parameters

- Batch scoring — upload CSV files for bulk scoring with summary stats

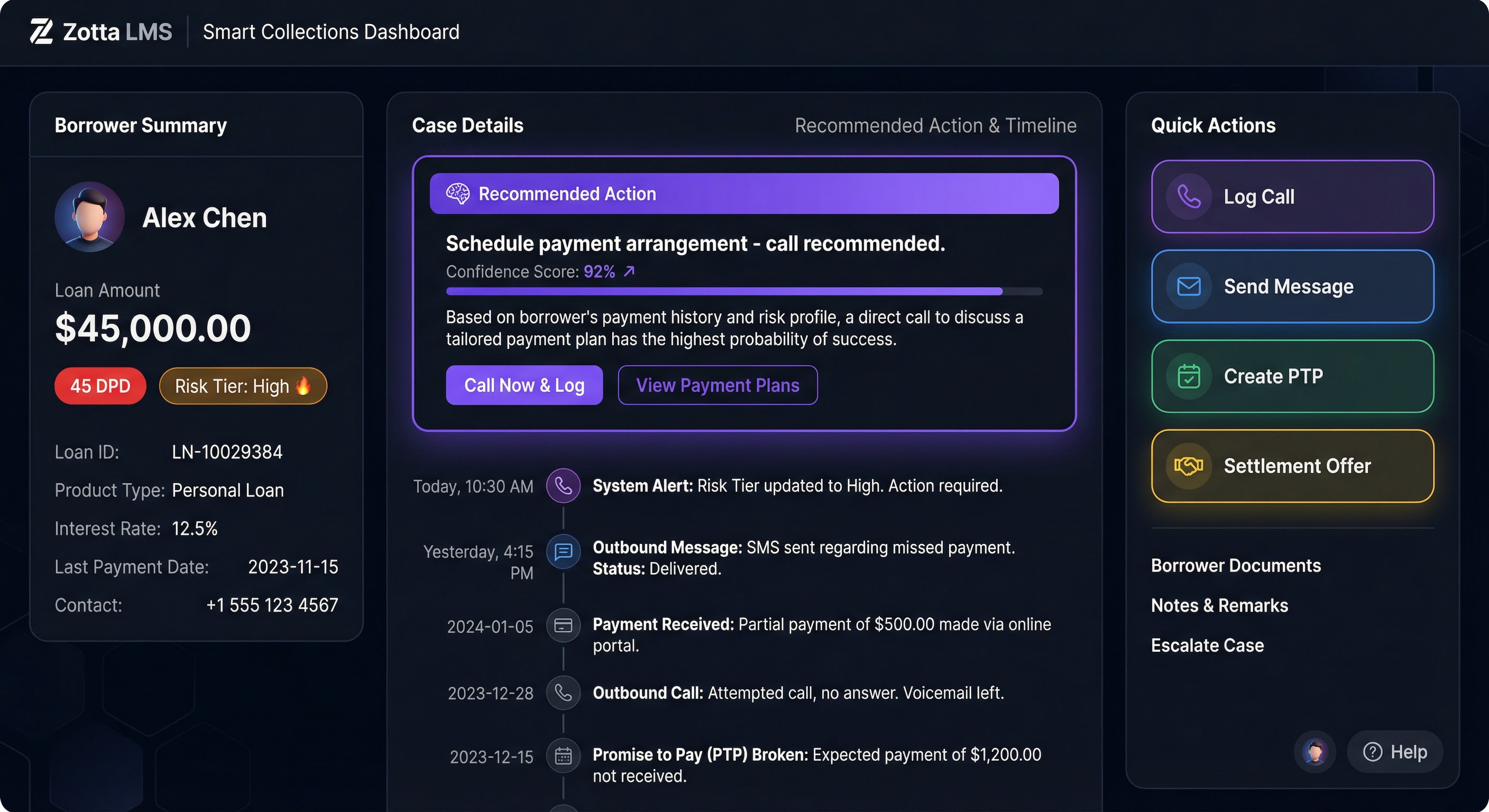

Intelligent Case Management

Every collection case surfaces the most effective next action for your agents. Prioritized queues, full interaction timelines, and one-click workflows keep resolution rates high and SLAs on track.

- Recommended next action with confidence scoring for each case

- Prioritized queues by days-past-due, risk tier, and agent assignment

- Promise-to-pay tracking with automatic status monitoring

- Settlement offer calculator with configurable approval workflows

- Built-in compliance engine — contact frequency limits, time-of-day rules

- WhatsApp, SMS, and email outreach with full conversation history

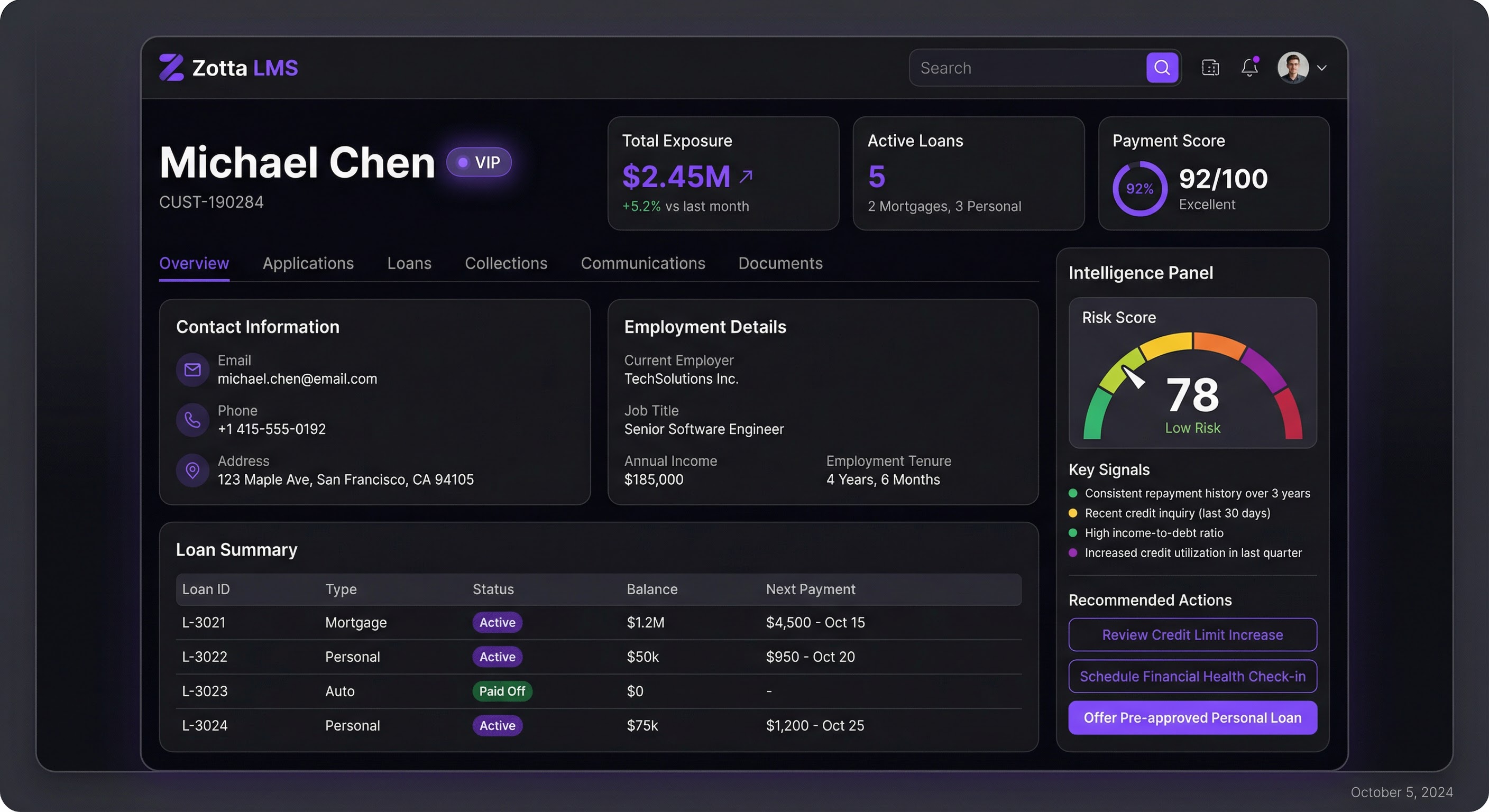

Complete Borrower Intelligence

A unified view of every customer — their applications, loans, payments, communications, and documents — all in one place. An intelligence panel highlights key signals and recommended next steps.

- Unified profile with total exposure, active loans, and payment score

- Tabbed navigation: Overview, Applications, Loans, Collections, Comms, Docs

- Intelligence sidebar with risk score, key signals, and action suggestions

- Chronological event timeline across all system interactions

- Natural language search — ask questions about any customer in plain English

- Quick links to related applications, collection cases, and conversations

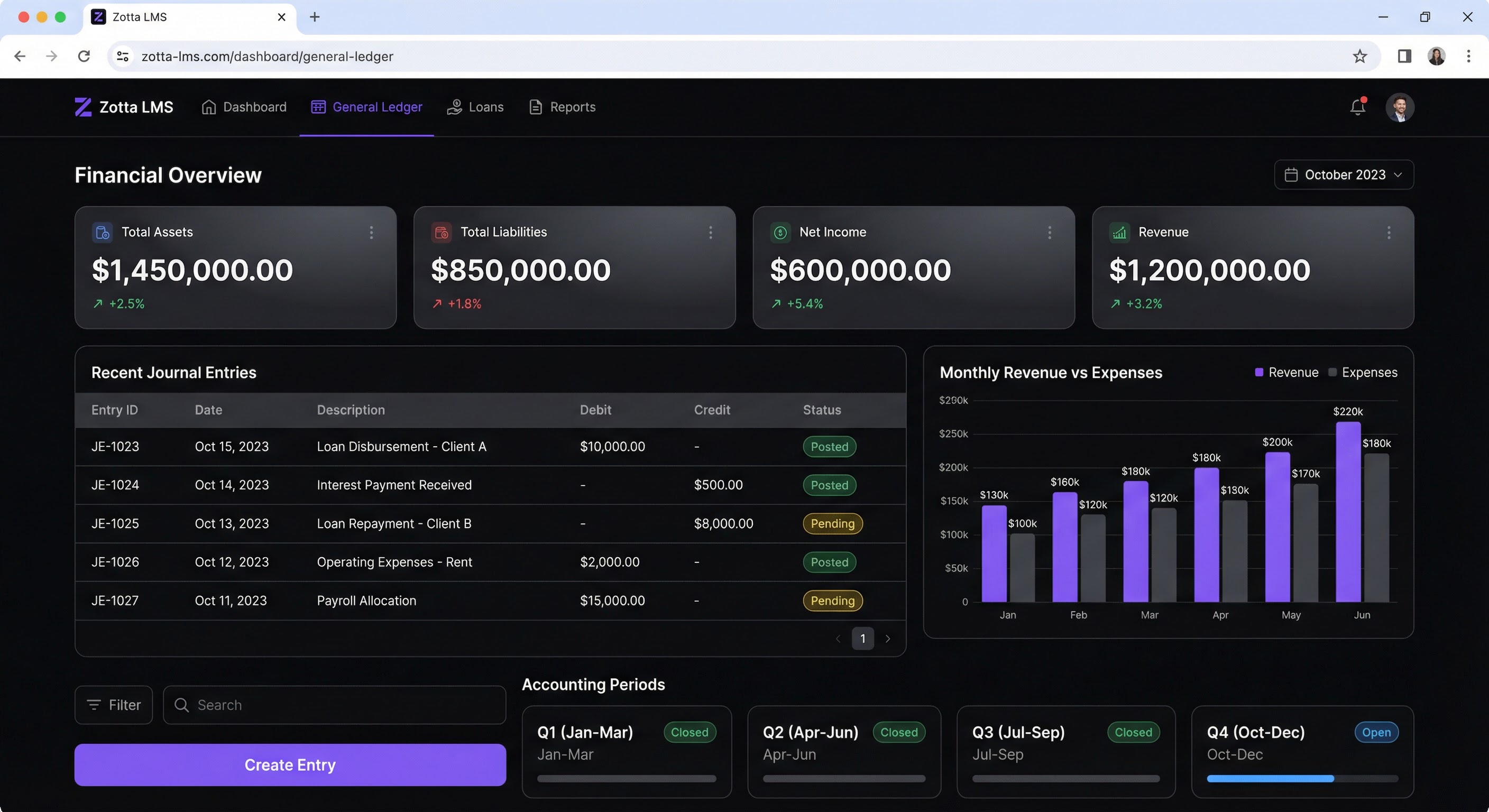

Full Double-Entry Accounting

A complete accounting system built into the platform. Automated GL mapping eliminates manual journal entries, while real-time financial dashboards keep your finance team in control.

- Hierarchical chart of accounts — assets, liabilities, equity, revenue, expenses

- Automated journal entries triggered by loan events (disbursement, payment, write-off)

- Maker-checker approval workflow for journal entries

- Balance sheet, income statement, and trial balance generation

- Accounting period management with period-close automation

- Anomaly detection surfaces unusual entries for review

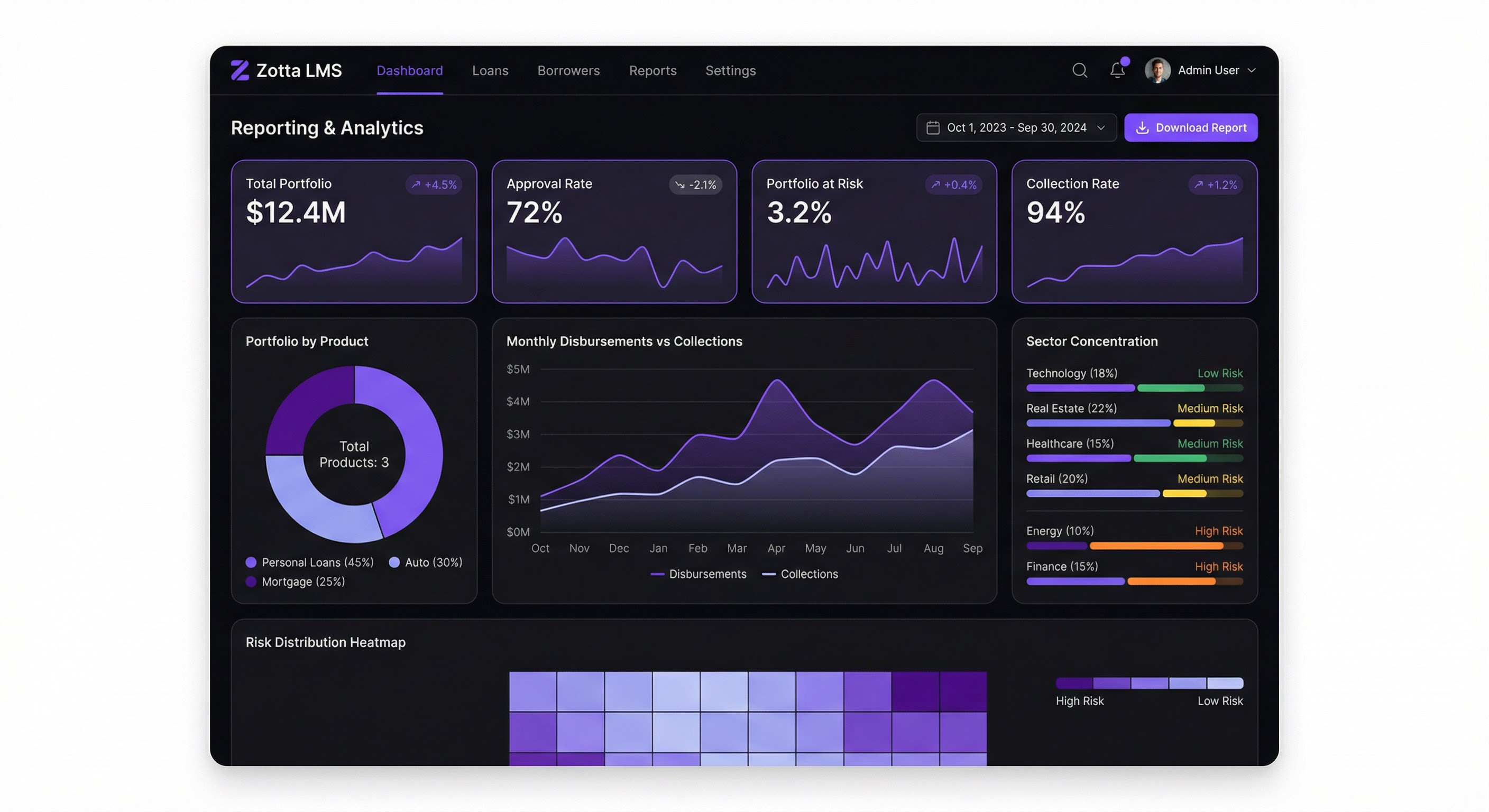

Real-Time Portfolio Insights

KPI dashboards, portfolio analytics, sector concentration analysis, and stress testing — all updated in real time. Export any report to CSV or schedule automated delivery.

- Live KPIs — total portfolio, approval rate, portfolio at risk, collection rate

- Portfolio breakdown by product, sector, and risk band

- Monthly disbursement vs. collection trend charts

- Sector concentration dashboard with risk heatmaps

- Stress testing — simulate portfolio impact under adverse scenarios

- Standard reports: aged receivables, loan book, decision audit trail, and more